Table of Content

"Chase Private Client" is the model name for a banking and funding product and service offering, requiring a Chase Private Client Checking account. Get extra from a personalized relationship with a devoted banker to help you manage your everyday banking wants and a J.P. Morgan Private Client Advisor who will help develop a personalized investment strategy to satisfy your evolving wants.

We do our greatest to maintain up present info, but because of the rapidly altering surroundings, some info may have modified because it was printed. Please do the suitable research before participating in any third celebration presents. Let’s have a glance at one example by way of an organization I work with called CIT Bank, the method will be comparable for most other banks. Opinions expressed here are the creator's alone, not these of any bank or monetary institution. This content has not been reviewed, permitted or in any other case endorsed by any of these entities.

Learn About Bank Of America Solutions

Information offered on these webpages is not meant to offer, and should not be relied on for tax, authorized and accounting recommendation. You should consult your own tax, authorized and accounting advisors before engaging in any financial transaction. Products, accounts and companies are provided via totally different service fashions (for example, self-directed, full-service).

They can help with any financial wants, from mortgages to auto loans to private banking and investment accounts. If you’re on the lookout for a easy, safe method to put aside some cash for a child, a standard kids savings account is most likely going the finest choice. However, attempt to find an account that gives a better yield when attainable. If the plan is to keep the funds within the account for an prolonged period, the next yield is likely worth it in the lengthy term.

Check Out These Instruments

Charles Schwab is our choice for the best overall custodial account due to its sturdy customer help, low charges, and many years of experience in the business. But custodial account contributions, like the account itself, are irrevocable. While mother and father take pleasure in near limitless administration for years, finally the account comes under the child's management, on the legal age of maturity in their state.

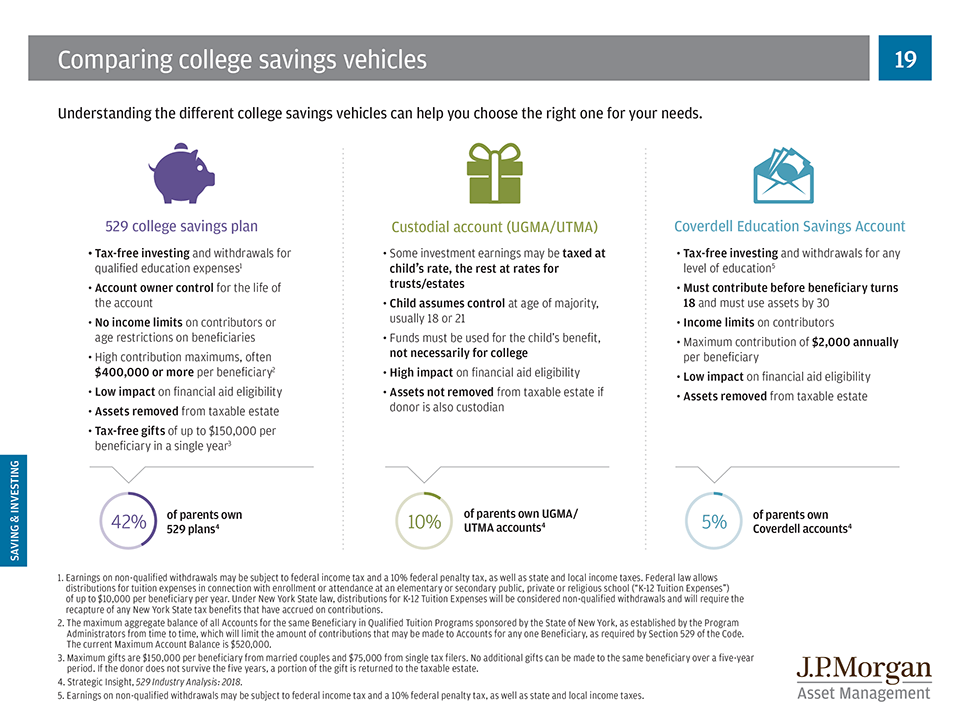

A custodial account lets you make investments on behalf of a minor for a school training or some other expense that advantages them. Also, the custodial account beneficiary can't be altered, whereas, the beneficiary on a 529 faculty plan might change with some limitations. Since the account is irrevocable, the beneficiary of the account may not change, and no items or contributions made into the account can be reversed. Second, the kid will achieve full management over the cash once they attain maturity. Even if the child isn’t prepared for the money – if they aren’t mature sufficient or financially savvy enough – they may nonetheless have control over the money once they reach the age of majority.

NerdWallet strives to maintain its data accurate and updated. This info may be different than what you see whenever you visit a monetary establishment, service provider or specific product’s website. All monetary merchandise, purchasing services and products are presented without guarantee. When evaluating presents, please evaluation the monetary institution’s Terms and Conditions. If you discover discrepancies together with your credit score rating or info out of your credit report, please contact TransUnion® immediately.

UTMA accounts can maintain those investments while together with other property similar to real property. Two main forms of custodial accounts that exist were made attainable by specific acts of legislation. These laws make sure that the funding accounts serve their objective in providing the most important possible advantages to the kid. Otherwise, these investments could be lumped in with a parent’s earnings and probably seized to satisfy sure debts. Therefore, it’s clever to use a custodial account specifically to build up financial savings for a kid. A custodial account is a means by which an adult can open a savings account for a kid.

As famous above, custodial accounts can put cash into a variety of belongings. However, the monetary institution probably will not permit the manager to make use of the account to commerce on margin or buy futures, derivatives, or other highly speculative investments. EarlyBird is an organization that gives custodial funding accounts for children to make it easy for family and pals to present money to your minor to invest. Although a custodial account may require some cautious planning, it could make an actual difference in your child’s monetary future.

The custodian should switch the account to the child inside an allotted time frame as quickly as the child reaches a certain age . The custodian shall be notified by Fidelity when the transfer needs to be initiated. A financial advisor can take a complete have a look at your funds and build a plan for the future.

To be taught more about the Acorns app, click on the link under or take a look at our full evaluate. The fundamental Greenlight account features a free debit card for spending, and a chores characteristic that permits mother and father to set duties and pay youngsters upon completion. Although Greenlight isn’t a conventional UTMA/UGMA account, it's parent-controlled and lets children spend, save, and make investments. Anyone who has your minor child’s EarlyBird hyperlink can make deposits. They can even embody a customized video along with the gift.

And there isn't any age limit for making contributions and withdrawals, however account ownership might be transferred to the minor upon age of termination. You can contribute as much as the annual gifting limits of $16,000 (or $32,000 for couples) yearly reward tax-free. Merrill provides transparent pricing for trades, account services and investment advisory packages.

Investing entails market danger, including potential loss of principal, and there could be no assure that funding objectives will be achieved. The Uniform Transfers to Minors Act is an act that enables a minor to receive presents similar to cash, real property, and fine artwork with out help. Amanda Bellucco-Chatham is an editor, author, and fact-checker with years of experience researching personal finance matters. Specialties embrace basic monetary planning, profession growth, lending, retirement, tax preparation, and credit score. She has 20+ years of expertise covering personal finance, wealth administration, and business news. Custodial accounts can be a great teaching software, a method to teach your youngster about managing money, and the facility of compound interest.

Parents who need to transfer property to or deposit cash for his or her youngster in their child’s name solely often accomplish that in the type of a custodial account. There are many kinds of custodial accounts you can open for youths beneath 18. You can select from spending or checking accounts, savings accounts, brokerage accounts, IRA accounts, and training savings accounts. UGMA accounts permit minors to own cash property corresponding to money, shares, bonds, and mutual funds.

No comments:

Post a Comment